Unlocking ADHD Financial Assistance: Resources and Options for Managing Expenses

Managing finances can be a daily struggle for individuals with Attention Deficit Hyperactivity Disorder (ADHD). Understanding the financial challenges of ADHD is crucial for seeking ADHD financial assistance. Individuals with ADHD often face difficulties with impulsivity, working memory, and organization, leading to issues with budgeting, saving, and debt management. Common financial challenges include impulsive purchases, lost or forgotten bills, and difficulty keeping track of expenses. Fortunately, ADHD financial assistance resources are available, including disability benefits, financial counseling, and ADHD-friendly budgeting tools. By recognizing the financial challenges of ADHD and seeking ADHD financial assistance, individuals can better manage their finances and improve their overall well-being.

Patient Assistance Programs: Reducing ADHD Medication Costs

Unlocking ADHD Financial Assistance: How Patient Assistance Programs Can Reduce Medication CostsIndividuals living with Attention Deficit Hyperactivity Disorder (ADHD) often face significant financial burdens when it comes to affording prescription medications. However, Patient Assistance Programs (PAPs) offer a beacon of hope for those struggling to cover the costs of ADHD treatment. By partnering with pharmaceutical companies and non-profit organizations, these programs provide eligible patients with free or discounted ADHD medications, significantly reducing out-of-pocket expenses. Through ADHD financial assistance, individuals can access the treatment they need without breaking the bank. Learn more about PAPs and how they can help make ADHD management more affordable.

Navigating Insurance and Public Benefits for ADHD Financial Assistance

Unlocking ADHD Financial Assistance: Navigating Insurance and Public Benefits for Long-Term Support. Discover how to maximize insurance coverage and leverage public benefits to access affordable treatments, therapies, and resources for ADHD management, and explore the various options for ADHD financial assistance to achieve a more stable financial future.

Managing Money with ADHD: Strategies for Successful Financial Planning

Mastering ADHD Financial Assistance: Proven Strategies for Effective Money Management

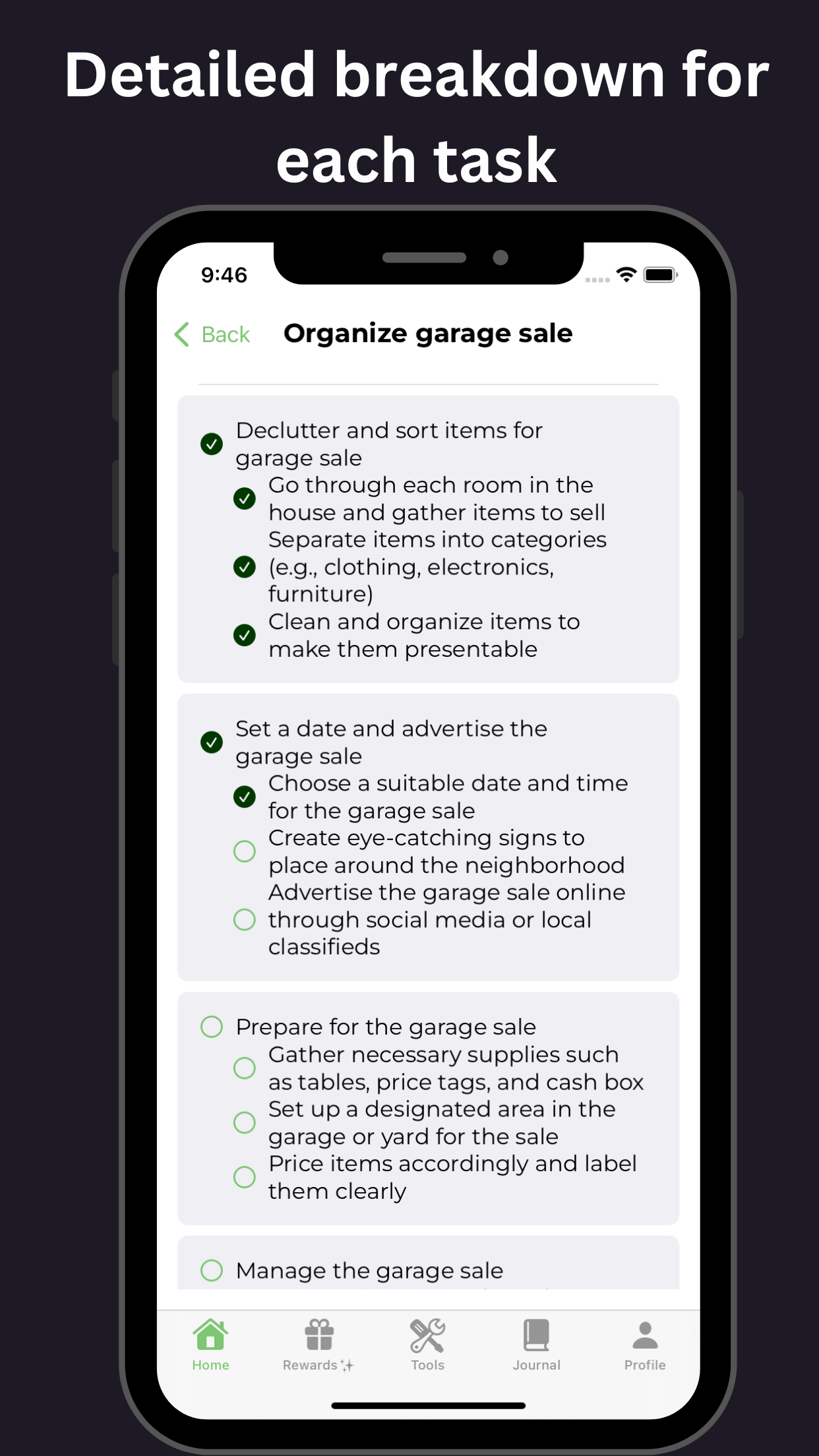

Living with ADHD can present unique challenges when it comes to managing finances, but with the right strategies, individuals can overcome these obstacles and achieve financial stability. This article provides expert guidance on ADHD financial assistance, offering practical tips and techniques to help individuals with ADHD take control of their financial lives. From creating personalized budgeting systems to leveraging technology for expense tracking, we’ll explore the most effective strategies for successful financial planning and ADHD financial assistance.

Financial Help for Adults with ADHD: Managing Money and Debts

Adults with ADHD often struggle with managing finances, leading to debt and financial stress. Fortunately, there are resources available for ADHD financial assistance. From budgeting tools and apps to credit counseling services, individuals with ADHD can get help managing their money and debts. Additionally, certain government programs and non-profit organizations offer financial assistance and education specifically designed for individuals with ADHD. By tapping into these resources, adults with ADHD can take control of their finances, reduce debt, and achieve long-term financial stability. For individuals struggling with ADHD financial assistance, there is hope for a more secure financial future.

ADHD and Your Finances: Managing Impulsive Spending and Budgeting

Individuals with Attention Deficit Hyperactivity Disorder (ADHD) often face unique financial challenges, including impulsive spending and disorganized budgeting. However, with the right strategies and ADHD financial assistance, it’s possible to manage finances effectively. By implementing impulse control techniques, automating savings, and breaking down large tasks into smaller ones, individuals with ADHD can overcome common financial obstacles. Additionally, utilizing ADHD-friendly budgeting tools and seeking support from financial advisors or therapists can provide essential ADHD financial assistance. By adopting these strategies, individuals with ADHD can regain control over their finances and achieve long-term financial stability.

Finding Financial Advisors Specialized in ADHD Financial Planning

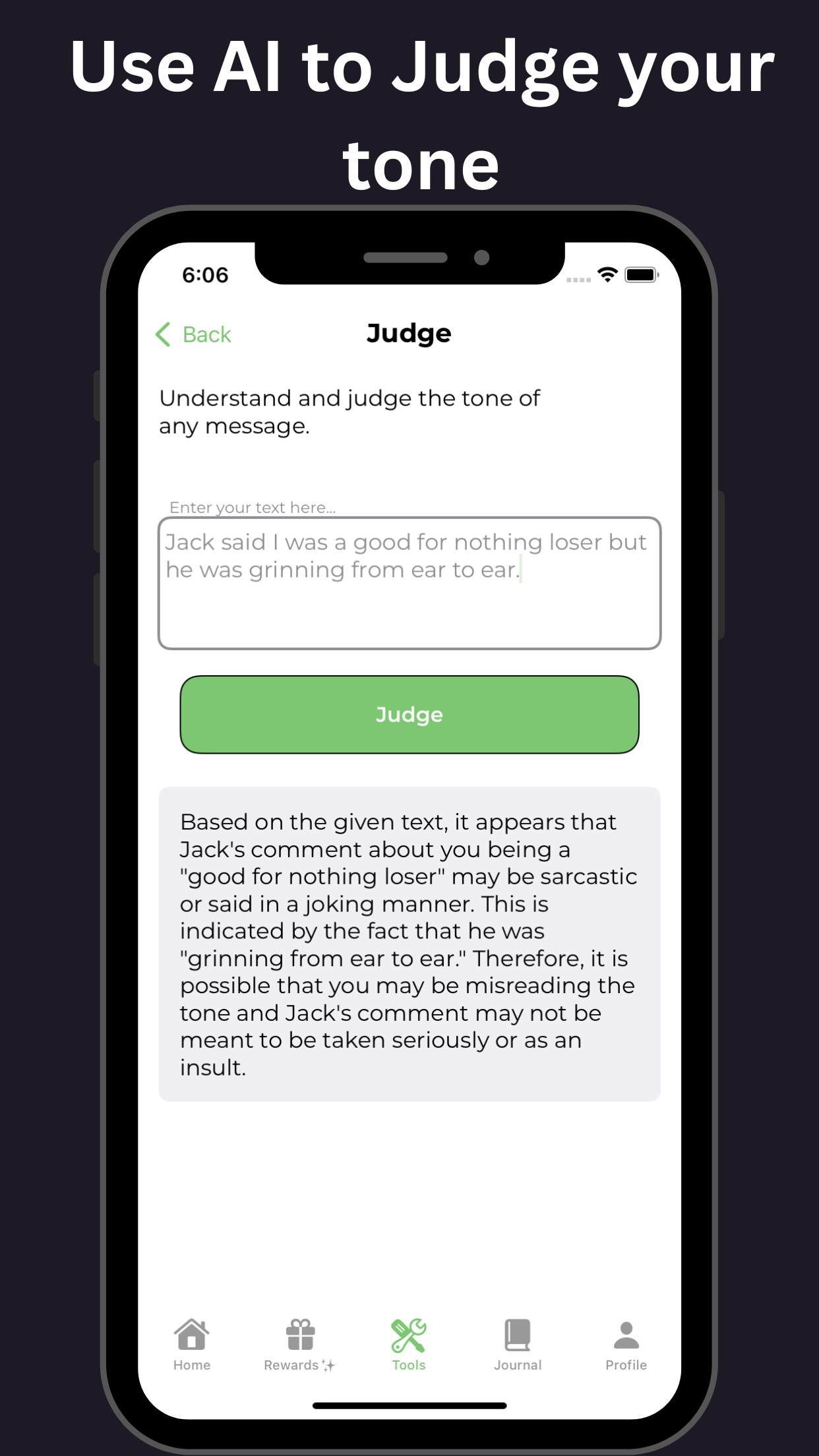

Finding a financial advisor experienced in ADHD financial assistance can be a game-changer for individuals with Attention Deficit Hyperactivity Disorder (ADHD). These specialized professionals understand the unique financial challenges associated with ADHD, such as impulsive spending, difficulty with budgeting, and impaired financial decision-making. By working with an ADHD financial advisor, individuals can receive personalized guidance on managing their finances, creating customized budgets, and developing strategies to overcome ADHD-related financial obstacles. With the right ADHD financial assistance, individuals can take control of their financial lives and achieve long-term financial stability.

The Financial Toll of Living with ADHD: Executive Function Challenges

Here is a summary for a blog article about the financial toll of living with ADHD and the importance of ADHD financial assistance:

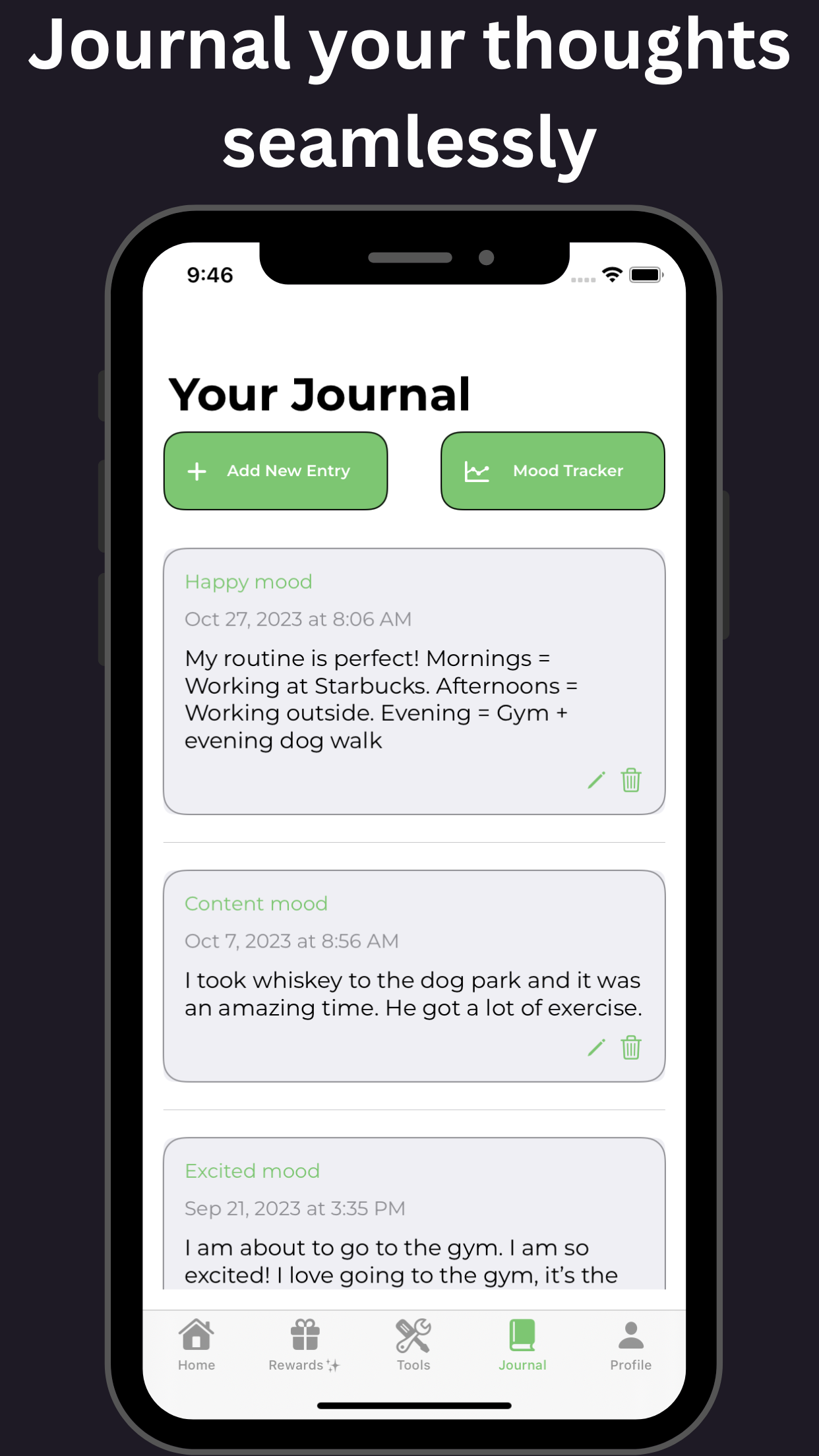

“Living with ADHD can have a significant impact on one’s financial well-being, with executive function challenges leading to difficulties with money management, budgeting, and planning. Individuals with ADHD often struggle with impulsive spending, debt accumulation, and poor financial decision-making, resulting in financial stress and anxiety. This article explores the financial toll of living with ADHD and highlights the need for ADHD financial assistance, providing resources and strategies for individuals with ADHD to overcome common financial challenges and achieve financial stability.”

ADHD and How to Manage Money, Pay Bills: Tips and Resources

Here is a summary for a blog article about ADHD and managing finances:

“Individuals with Attention Deficit Hyperactivity Disorder (ADHD) often face unique challenges when it comes to managing their finances. Disorganization, impulsivity, and difficulty with time management can lead to missed payments, late fees, and financial stress. However, with the right strategies and ADHD financial assistance, individuals with ADHD can learn to manage their money and pay bills effectively. This article provides tips and resources on ADHD financial assistance, including creating a budget, automating payments, and using visual reminders to stay on track. By implementing these strategies, individuals with ADHD can take control of their finances, reduce stress, and achieve long-term financial stability.”

This summary incorporates SEO techniques by:

- Using the long-tail keyword “ADHD financial assistance” to attract relevant search traffic

- Incorporating related keywords, such as “managing finances”, “pay bills”, and “financial stress”

- Providing a clear and concise summary that answers the question “how can individuals with ADHD manage their finances effectively?”

ADHD Support Groups: Finding Financial Aid and Resources

Securing ADHD Financial Assistance: A Guide to Support Groups and Resources for Affordability. Discover organizations offering ADHD financial aid, insurance options, and cost-saving strategies to make managing ADHD more affordable. Explore these valuable resources for ADHD financial assistance to alleviate the financial burden of treatment.

Government Assistance Programs for ADHD Financial Assistance

“Government Assistance Programs for ADHD Financial Assistance: Unlocking Support for Individuals and Families”

Individuals with Attention Deficit Hyperactivity Disorder (ADHD) often face unique financial challenges, from medical expenses to educational and occupational accommodations. Fortunately, various government assistance programs offer ADHD financial assistance to alleviate these burdens. This article explores the available programs, eligibility criteria, and benefits, providing a comprehensive guide to securing ADHD financial assistance.

Key programs include:

- Supplemental Security Income (SSI): Providing cash assistance for adults and children with ADHD who meet specific income and resource requirements.

- Social Security Disability Insurance (SSDI): Offering financial support for individuals with severe ADHD, unable to work due to their condition.

- Individuals with Disabilities Education Act (IDEA): Funding special education services and accommodations for children with ADHD.

- Medicaid and the Children’s Health Insurance Program (CHIP): Covering medical expenses, including ADHD diagnosis, treatment, and medication.

- State-specific programs: Many states offer additional assistance, such as vocational training and employment services, for individuals with ADHD.

By understanding these government assistance programs, individuals with ADHD and their families can access essential ADHD financial assistance, promoting greater financial stability and overall well-being.

Non-Profit Organizations Providing ADHD Financial Assistance

Accessing ADHD Financial Assistance: Non-Profit Organizations Providing ReliefIndividuals and families affected by Attention Deficit Hyperactivity Disorder (ADHD) often face significant medical expenses, including diagnosis, treatment, and medication costs. Fortunately, various non-profit organizations offer ADHD financial assistance to alleviate this burden. These organizations provide crucial support, ensuring that individuals with ADHD receive the necessary care and resources. Some notable non-profits offering ADHD financial assistance include the ADHD Foundation, the Edge Foundation, and the National Center for Learning Disabilities. These organizations provide a range of services, including medication copay assistance, therapy session funding, and educational resources. By leveraging these resources, individuals with ADHD can access the care they need to thrive.In today’s economic climate, ADHD financial assistance is more crucial than ever. By understanding the options available, families can secure the necessary support to manage this condition effectively. If you or a loved one is struggling with ADHD, explore these non-profit organizations and discover the ADHD financial assistance opportunities available to you.

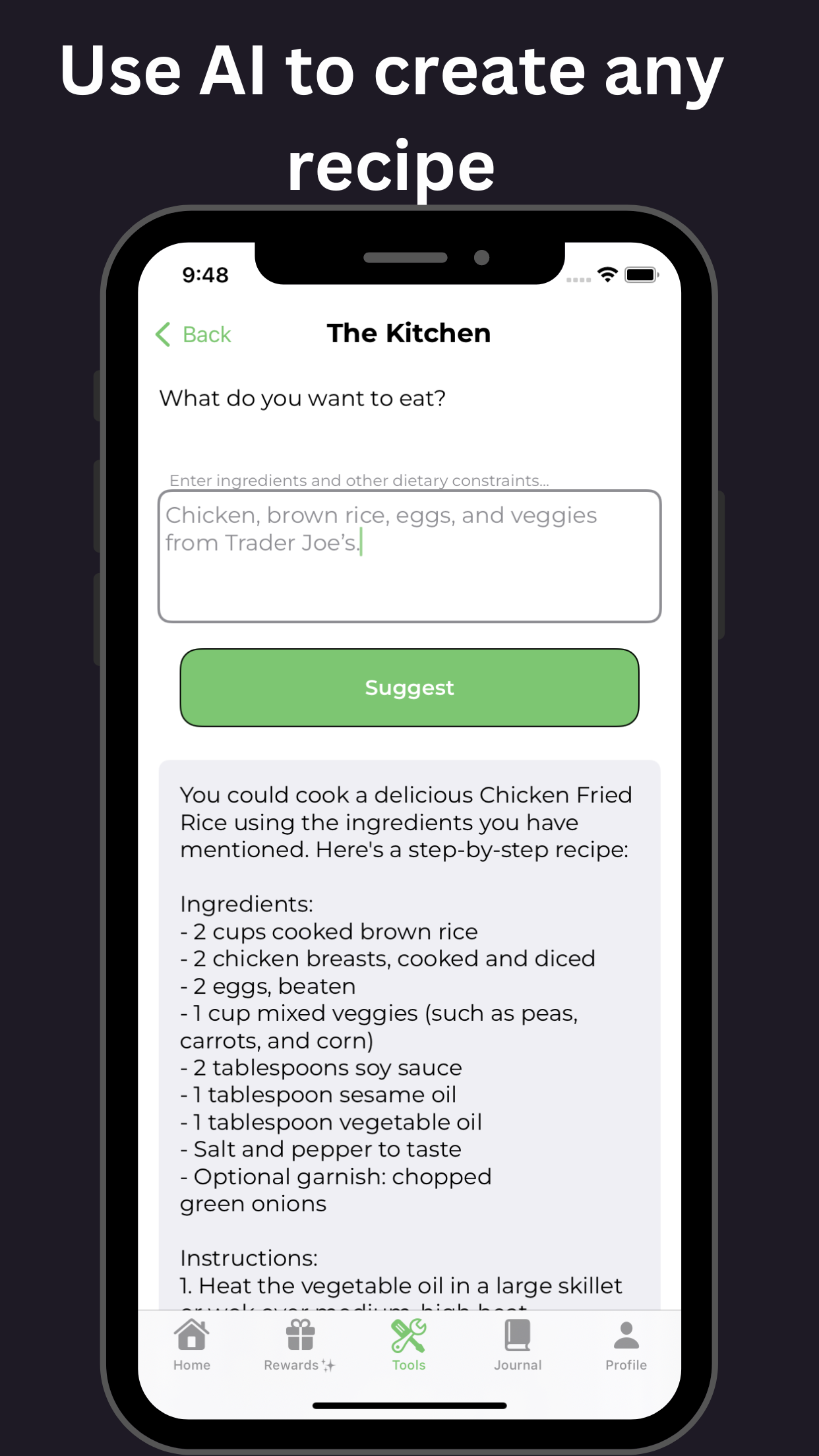

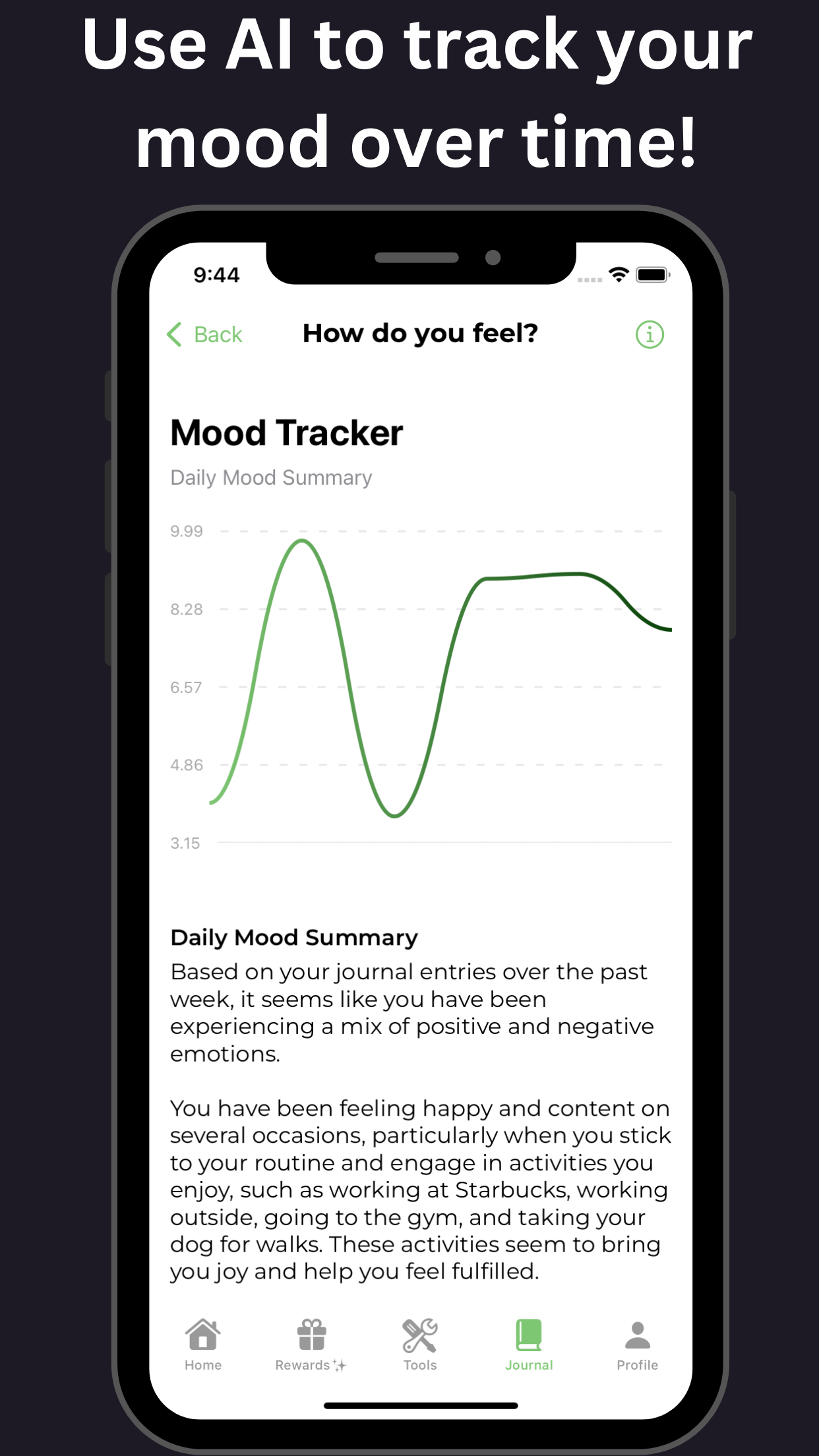

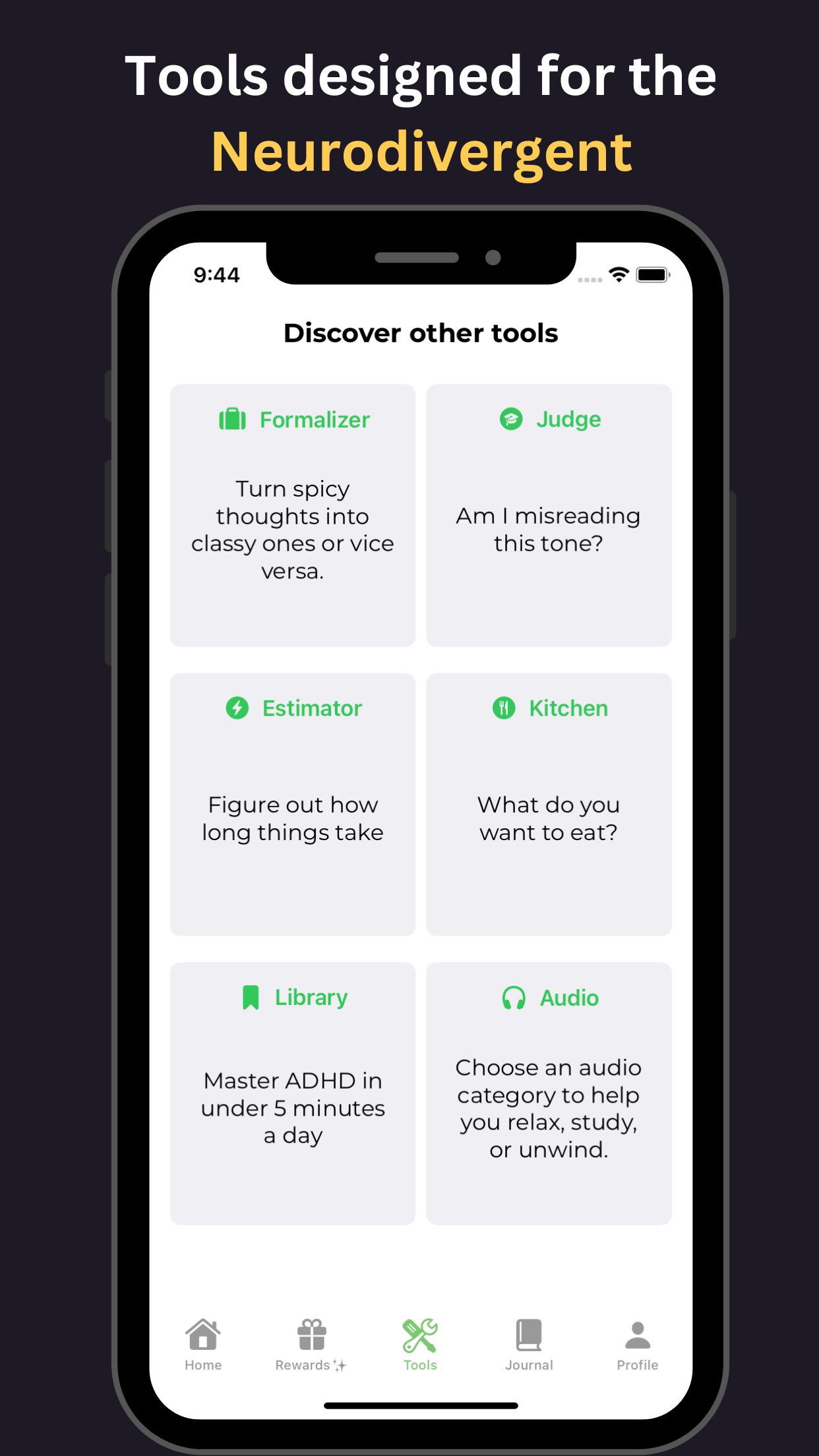

Online Resources for ADHD Financial Management and Planning

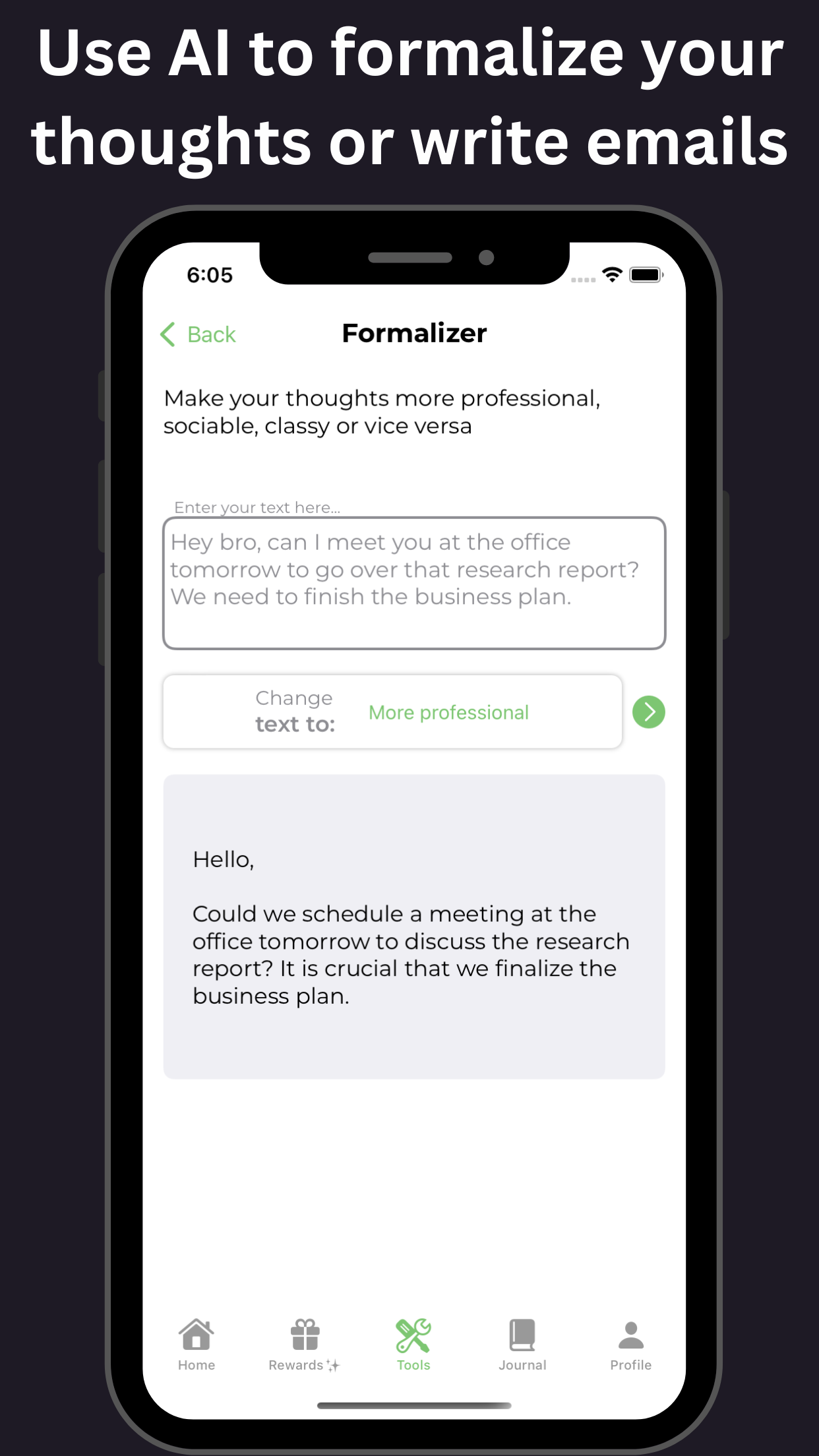

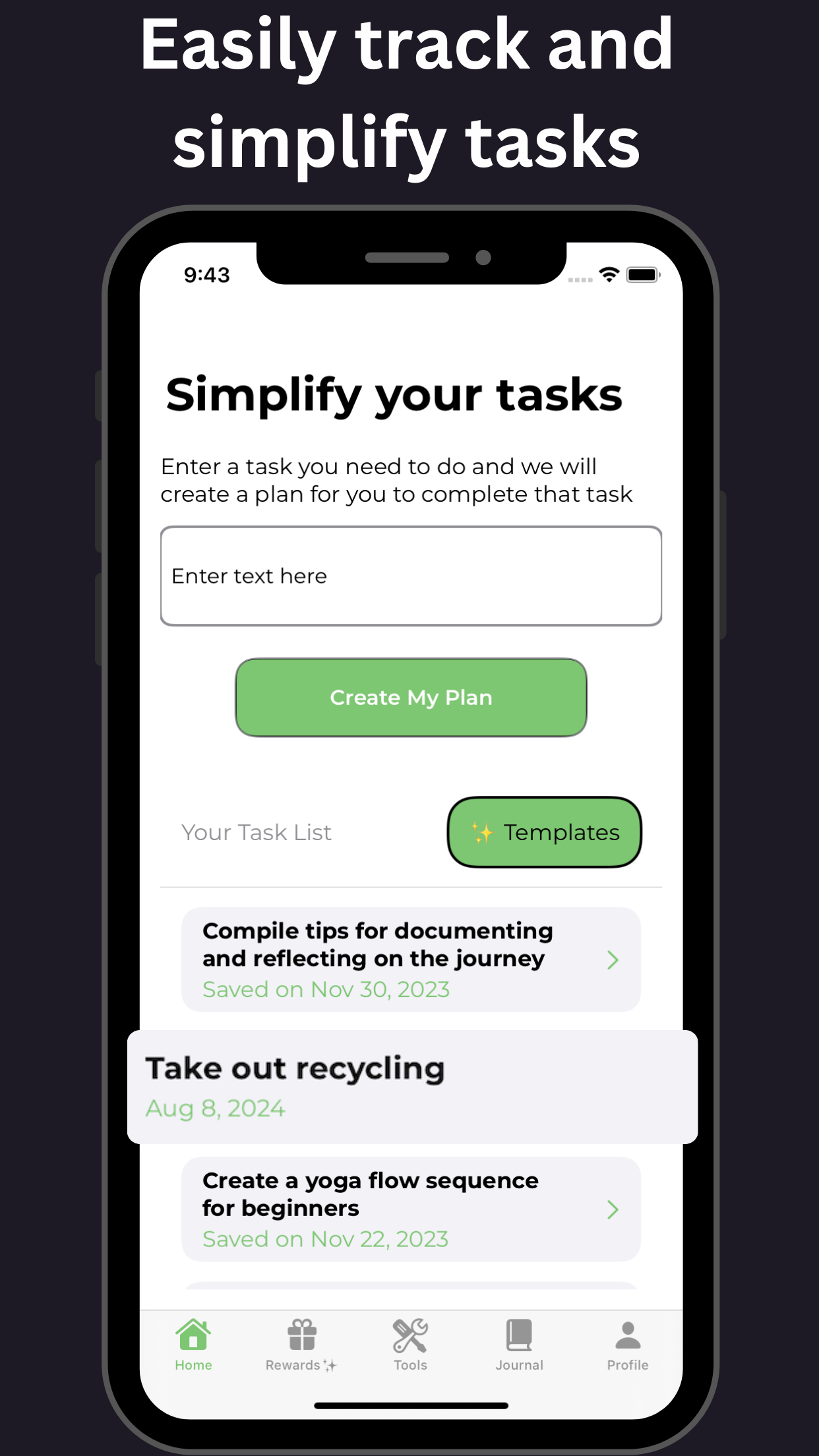

Mastering ADHD Financial Assistance: Top Online Resources for Effective Management and Planning. Individuals with Attention Deficit Hyperactivity Disorder (ADHD) often face unique financial challenges. Fortunately, a plethora of online resources are available to provide ADHD financial assistance, empowering individuals to take control of their financial lives. From budgeting tools to personalized coaching, these online resources offer tailored support for ADHD financial management and planning. Explore the best online resources for ADHD financial assistance, including apps, websites, and expert guidance, to achieve financial stability and independence.

Creating a Budget with ADHD: Tips for Staying on Track

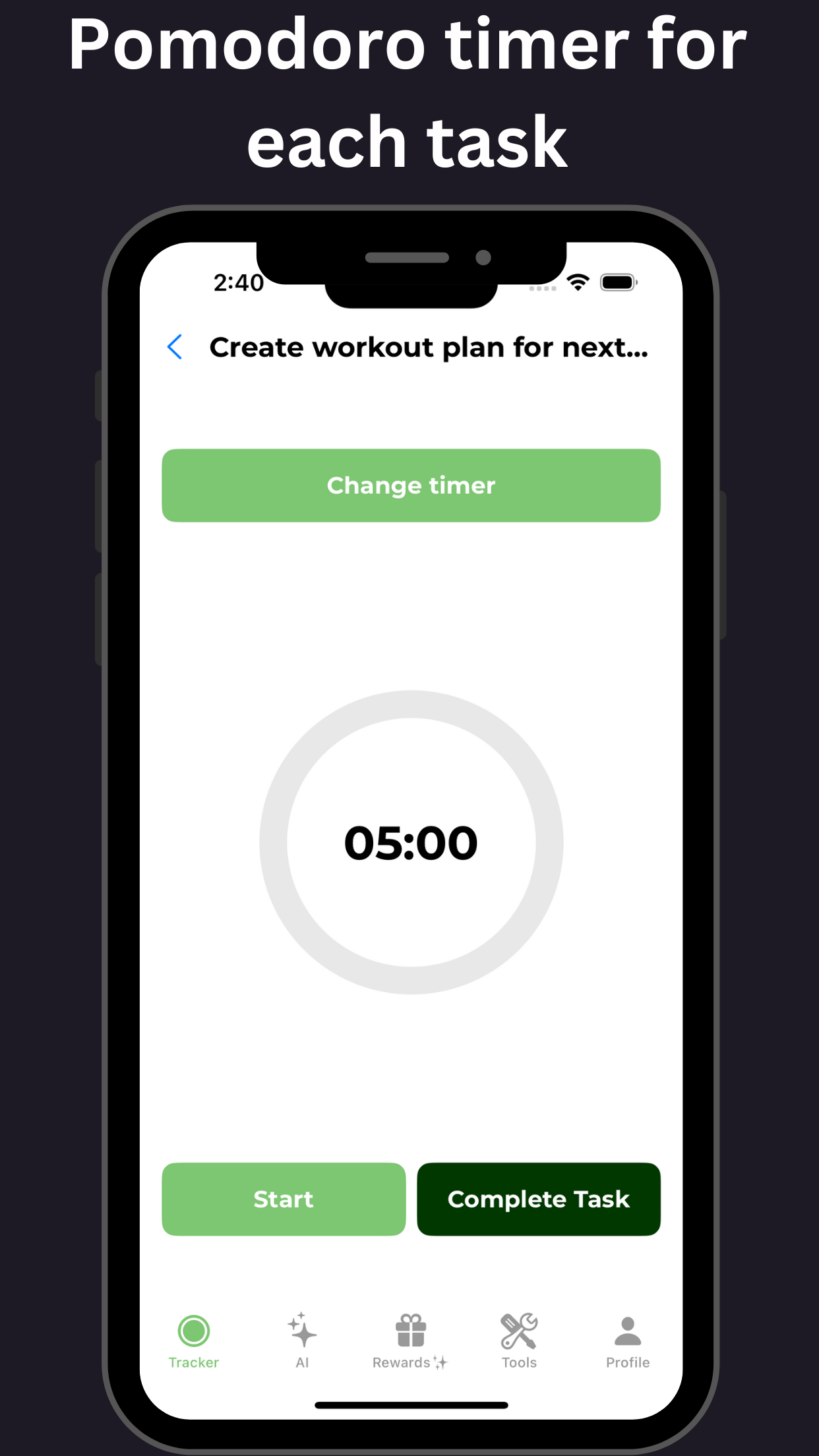

Mastering ADHD Financial Assistance: Expert Tips for Creating a Budget that SticksLiving with ADHD can make managing finances a daunting task, but with the right strategies, achieving stability is within reach. Here’s a comprehensive guide to creating a budget with ADHD, providing tailored advice for staying on track and securing ADHD financial assistance.Discover how to:* Break down complex financial goals into manageable tasks* Utilize visual aids and technology to streamline budgeting* Leverage accountability partners and support systems* Overcome emotional spending habits and impulsivity* Tap into specialized resources for ADHD financial assistanceTake control of your finances and unlock a brighter financial future with these expert-backed tips, designed specifically for individuals with ADHD seeking ADHD financial assistance.

ADHD Financial Coaching: Working with a Professional Advisor

Take Control of Your Finances: How ADHD Financial Coaching with a Professional Advisor Can Provide ADHD Financial Assistance. Individuals with Attention Deficit Hyperactivity Disorder (ADHD) often face unique financial challenges, including impulsivity, disorganization, and difficulties with time management. A specialized ADHD financial coach can provide personalized ADHD financial assistance, helping you create a budget, prioritize spending, and develop strategies to overcome common obstacles. With the guidance of a professional advisor, you can break free from financial stress and achieve long-term financial stability. Discover the benefits of ADHD financial coaching and take the first step towards unlocking ADHD financial assistance tailored to your needs.

Important Sources

| Reduce ADHD Costs with Patient Assistant Programs - Healthline | The Medicine Assistance Tool (MAT) is a search engine created by the Pharmaceutical Research and Manufacturers of America (PhRMA) to help people find financial assistance resources available ... |

| Insurance and Public Benefits - CHADD | Public Health Insurance. Medicaid. Medicaid is a jointly funded, federal-state health insurance program for certain low-income and needy people. It covers approximately 36 million individuals including children, the aged, blind, and/or disabled and people who are eligible to receive federally assisted income maintenance payments. Within broad ... |

| Managing Money and ADHD - CHADD | Managing finances can be a challenge for people with ADHD. The symptoms of procrastination, disorganization, and impulsivity can create problems with finances. The following fact sheets provide strategies, tips and resources that can help with successful money management: Managing Money and ADHD: Expenses and Goals Managing Money and ADHD: Minding Your Debts Managing Money and… |

| Financial Help for Adults with ADHD: Manage Your Money - ADDitude | Since 1998, millions of parents and adults have trusted ADDitude's expert guidance and support for living better with ADHD and its related mental health conditions. Our mission is to be your trusted advisor, an unwavering source of understanding and guidance along the path to wellness. |

| ADHD and Your Finances - WebMD | Some behavior traits that come with ADHD can make money management a challenge. ... Credit unions generally offer free financial counseling. Counselors offer help with everything from daily and ... |

| How to Budget: ADHD & Finances - ADDitude | Tweak Your ADHD Memory. Give yourself reminders about important, but infrequent, financial activities through a computerized schedule (Outlook) or paper day-planner. You may need reminders about: Annual or semi-annual meetings with your financial advisor to review and revise your investment portfolio; Dates for renewals of certificates of deposit |

| Are You an Adult with ADHD Looking for Financial Help? | A financial advisor who specializes in serving adults with ADHD can offer invaluable support and guidance to help their clients make smarter money moves and feel more confident about their personal finances. But it may not be easy to find a local financial advisor who is dedicated to understanding the unique needs of ADHD clients. |

| The Financial Toll of Living with ADHD - Verywell Mind | While many people think of ADHD as just struggling to focus or being easily distracted, the condition actually impacts most executive functions, including the ones needed for managing money. For example, poor working memory can cause you to forget dinner is in the oven, forget a bill is due, miss a doctor’s appointment (and get stuck paying a ... |

| ADHD and How to Manage Money, Pay Bills | HealthyPlace | There is financial help for adults with ADHD. Financial Help, Tips for Adults with ADHD. Money management is a learned skill. Even if your adult ADHD symptoms have been interfering with your financial health, you can learn and use money management strategies. One concept to remember as you work on new skills: the ADHD brain needs things to be ... |

| ADHD support groups: Benefits, options, and more - Medical News Today | Financial aid options for ADHD support groups can vary, depending on factors such as location, the nature of the support group, and available resources. Some potential avenues to explore for ... |