Mastering ADHD Taxes: Expert Guidance for Accurate Filing and Maximum Refunds

Key Takeaways

| Topic | Key Takeaways |

|---|---|

| Medical Expenses | Document medical expenses related to ADHD treatment, including therapy, medication, and diagnostic testing to claim as deductions on tax returns. |

| Education Expenses | Claim education-related expenses, such as tutoring, special education services, and educational software, as deductions on tax returns. |

| Disability Tax Credit | Individuals with severe ADHD may be eligible for the Disability Tax Credit, which provides a non-refundable tax credit of up to $8,416. |

| Child and Dependent Care Credit | Claim the Child and Dependent Care Credit for expenses related to before- and after-school programs, summer camps, or adult day care services for individuals with ADHD. |

| Business Expense Deductions | Self-employed individuals with ADHD can claim business expense deductions for accommodations, such as assistive technology or services, that help them work more efficiently. |

| Record-Keeping | Maintain detailed records of expenses, including receipts, invoices, and bank statements, to support tax deductions and credits. |

| Tax Professional Guidance | Consult a tax professional to ensure accurate interpretation and application of tax laws and regulations related to ADHD expenses. |

What is the ADHD Tax?: Understanding the concept of ADHD tax and its implications on daily life.

Unlocking the Concept of ADHD Tax: Understanding the Hidden Costs of Attention Deficit Hyperactivity Disorder

The ADHD tax refers to the additional emotional, financial, and time-related burdens individuals with Attention Deficit Hyperactivity Disorder (ADHD) and their families often experience in their daily lives. This phenomenon encompasses the exhaustive efforts to manage ADHD symptoms, navigate complex systems, and cope with the stigma surrounding the condition. The ADHD tax can lead to increased stress, anxiety, and feelings of guilt, affecting not only the individual but also their loved ones.

In this article, we will delve into the world of ADHD taxes, exploring how it impacts daily life, relationships, and overall well-being. By understanding the concept of ADHD tax, individuals and families can better navigate the challenges associated with this condition, ultimately reducing the emotional and financial burdens that come with it.

The Financial Toll of ADHD: How ADHD affects financial management, leading to additional costs and stress.

Here is a summary for a blog article about the financial toll of ADHD, focusing on the long-tail keyword "ADHD taxes":

"Living with ADHD can have a significant impact on one’s financial well-being, leading to additional costs and stress. Impulsivity and disorganization common in ADHD can result in missed payments, late fees, and forgotten tax deadlines, leading to increased ADHD taxes and penalties. Furthermore, ADHD individuals may struggle with budgeting, leading to overspending and debt accumulation. The financial toll of ADHD can also lead to reduced productivity, lost wages, and decreased earning potential. Effective management of ADHD taxes and other financial responsibilities is crucial to mitigate these negative consequences. By developing strategies to improve organization, time management, and impulse control, individuals with ADHD can better navigate financial responsibilities, reduce stress, and alleviate the financial burden of ADHD."

Impulse Spending and Late Fees: The Hidden Costs of ADHD: The impact of impulsive decisions and forgetfulness on personal finances.

Here is a summary about the topic Impulse Spending and Late Fees: The Hidden Costs of ADHD:

Individuals with Attention Deficit Hyperactivity Disorder (ADHD) often face unique financial challenges that can negatively impact their personal finances. Impulsive spending habits and forgetfulness can lead to a buildup of late fees, penalties, and other hidden costs, further exacerbating the stress of managing ADHD taxes. Without a clear understanding of these financial pitfalls, individuals with ADHD may struggle to stay on top of their finances, ultimately leading to financial insecurity and stress. By recognizing the impact of ADHD on personal finances and developing strategies to mitigate these effects, individuals can better navigate their financial lives, including managing ADHD taxes, and achieve greater financial stability.

The Emotional Cost of ADHD Tax: How the ADHD tax can lead to feelings of guilt, shame, and low self-esteem.

Uncovering the Hidden Toll of ADHD Taxes: How the Constant Struggle with Disorganization, Lost Items, and Forgotten Tasks Leads to Emotional Distress and Self-Doubt. The burden of ADHD taxes can have far-reaching emotional consequences, manifesting as feelings of guilt, shame, and low self-esteem. Individuals with ADHD often find themselves trapped in a cycle of missed deadlines, misplaced belongings, and forgotten commitments, leading to a crushing weight of emotional taxation. As the stress and anxiety of ADHD taxes accumulate, self-doubt and negative self-talk can become overwhelming, eroding self-confidence and self-worth. It’s essential to recognize the emotional cost of ADHD taxes and develop strategies to mitigate their impact, enabling individuals with ADHD to break free from the cycle of emotional distress and reclaim their self-esteem.

Overcoming ADHD Tax: Strategies for Financial Wellness: Practical tips and strategies for managing ADHD-related financial challenges.

Here is a summary for a blog article about overcoming ADHD taxes:

Mastering ADHD Taxes: Effective Strategies for Financial Freedom

Individuals with Attention Deficit Hyperactivity Disorder (ADHD) often face unique financial challenges, collectively known as “ADHD taxes”. These hidden costs can lead to financial stress, debt, and anxiety. Learn how to overcome ADHD taxes with practical tips and strategies to achieve financial wellness. From creating personalized budgeting systems to leveraging technology for expense tracking, discover how to break free from financial overwhelm and build a secure financial future.

The Link Between ADHD and Financial Disorganization: How ADHD symptoms can lead to financial disorganization and strategies for improvement.

Unraveling the Connection: How ADHD Symptoms Can Lead to Financial Disorganization and Strategies for Improvement

Individuals with Attention Deficit Hyperactivity Disorder (ADHD) often struggle with money management, leading to financial disorganization. ADHD symptoms, such as inattention, impulsivity, and lack of executive function, can result in missed payments, lost documents, and inaccurate record-keeping, ultimately affecting tax compliance and financial stability. This article explores the link between ADHD and financial disorganization, with a focus on managing ADHD taxes effectively. By understanding the challenges and implementing strategies for improvement, individuals with ADHD can regain control of their finances and reduce tax-related stress.

Strategies for Improvement:

- Create a System: Develop a personalized organizational system for managing financial documents, including tax-related papers.

- Automate Payments: Set up automatic payments for bills and taxes to avoid missed deadlines.

- Designate a ‘Tax Zone’: Allocate a specific space for storing and organizing tax-related documents.

- Seek Professional Help: Collaborate with a tax professional or financial advisor who understands ADHD-related challenges.

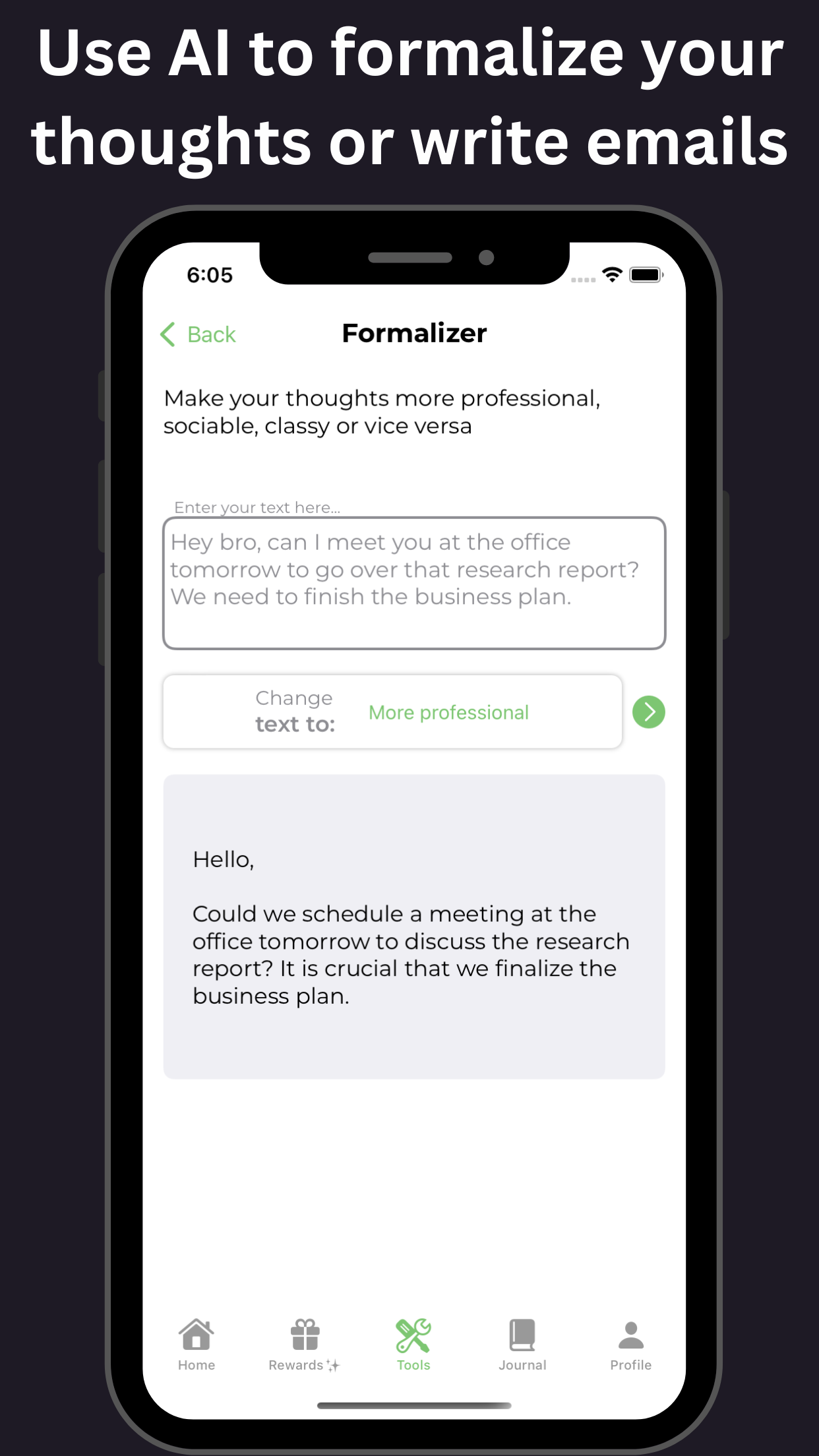

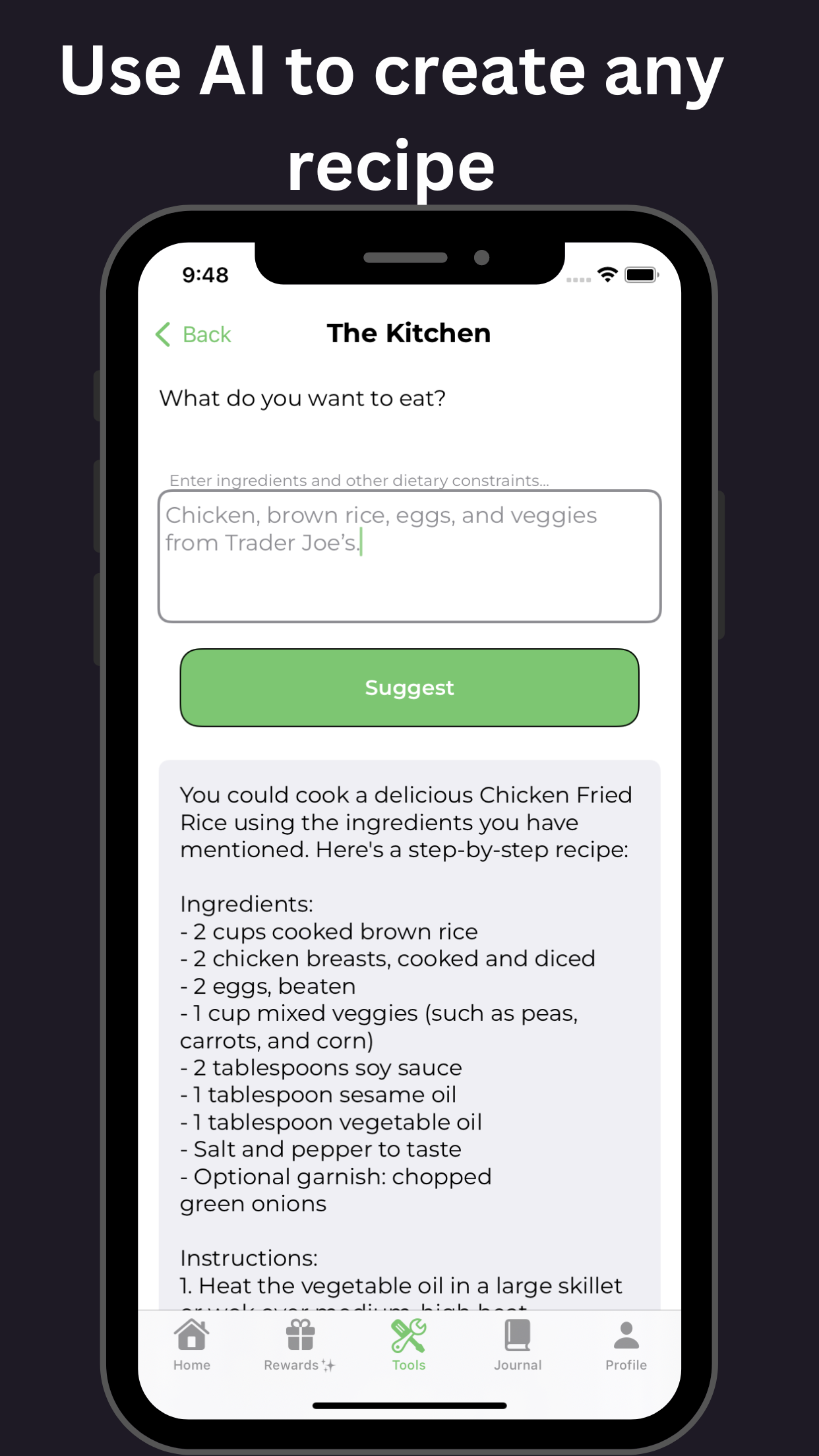

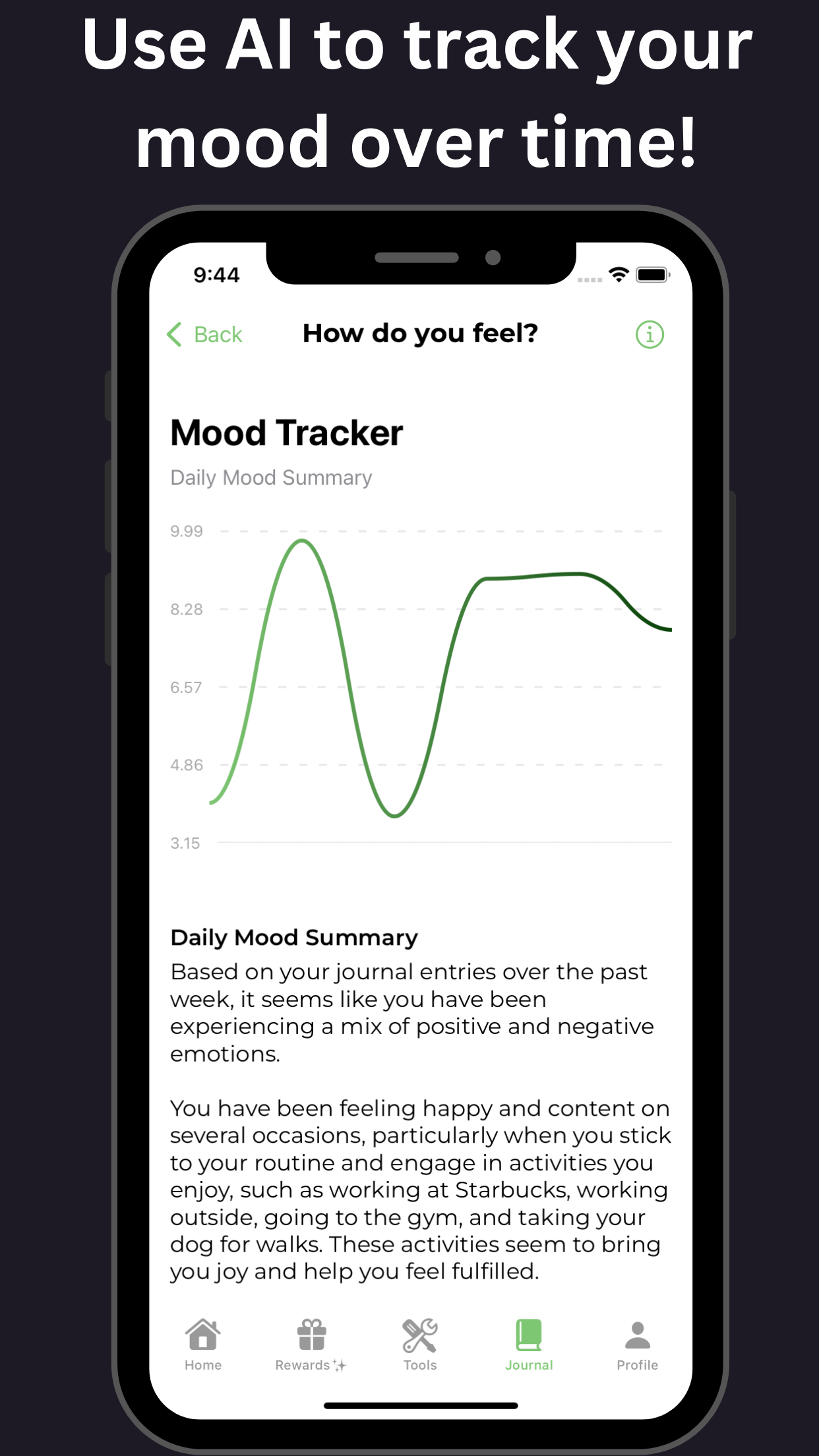

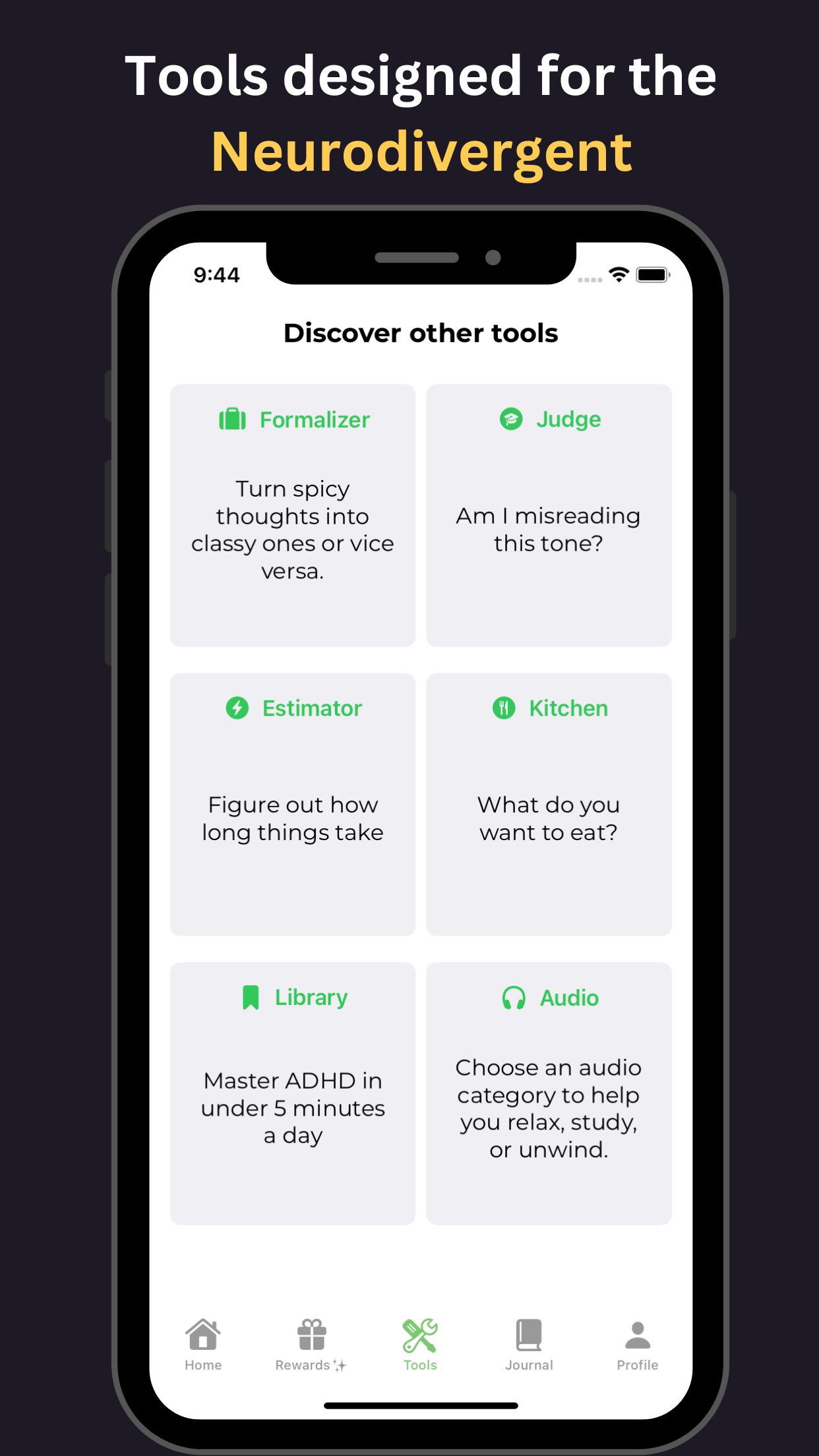

- Leverage Technology: Utilize digital tools, such as tax preparation software and mobile apps, to streamline financial management and ADHD taxes.

- Break Tasks into Smaller Steps: Divide complex financial tasks into manageable chunks to reduce feelings of overwhelm.

- Establish a ‘Tax Routine’: Schedule regular time slots for reviewing and addressing tax-related tasks.

By recognizing the impact of ADHD symptoms on financial organization and implementing these strategies, individuals can overcome the challenges of managing ADHD taxes and achieve greater financial stability.

Avoiding the ADHD Tax: Simple Changes for Better Money Management: Simple habits and systems to help individuals with ADHD better manage their finances.

Here is a summary for a blog article on the topic of avoiding the “ADHD tax” and managing finances with ADHD:

Avoiding the ADHD Tax: Simple Changes for Better Money Management

Individuals with Attention Deficit Hyperactivity Disorder (ADHD) often face unique financial challenges, resulting in what’s coined the “ADHD tax” - unnecessary expenses due to forgotten bills, late fees, and impulsive purchases. However, by implementing simple habits and systems, individuals with ADHD can better manage their finances and avoid the ADHD tax. This article explores practical strategies for creating a tailored financial system, including automating bill payments, using visual reminders, and leveraging technology to track expenses and stay on top of finances. By adopting these simple yet effective changes, individuals with ADHD can take control of their finances, reduce stress, and build a more secure financial future.

The ADHD Tax and Relationships: How it Affects Loved Ones: The impact of ADHD tax on personal relationships and strategies for mitigation.

Here is a summary of the topic “The ADHD Tax and Relationships: How it Affects Loved Ones” optimized for SEO with a focus on the long-tail keyword “ADHD taxes”:

“When an individual with Attention Deficit Hyperactivity Disorder (ADHD) struggles to manage daily tasks, meet deadlines, and stay organized, they often rely on their loved ones to pick up the slack. This phenomenon is known as the ‘ADHD tax,’ where relationships bear the weight of the individual’s ADHD-related challenges. The ADHD tax can lead to increased stress, frustration, and feelings of resentment among partners, family members, and friends. In this article, we’ll delve into the ways the ADHD tax affects personal relationships and explore strategies for mitigation, empowering individuals with ADHD and their loved ones to build stronger, more supportive bonds while minimizing the burden of ADHD taxes.”

Seeking Financial Wellness After Money Problems: How to recover from financial setbacks caused by ADHD tax and achieve long-term financial stability.

Here is a summary for the blog article on seeking financial wellness after money problems caused by ADHD taxes:

“Reclaim your financial freedom from the grip of ADHD taxes! If impulsive spending, forgotten deadlines, and disorganization have led to financial chaos, it’s time to break free. Learn how to overcome ADHD-related money problems and achieve long-term financial stability. Discover practical strategies to manage your finances, prioritize expenses, and create a budget that works for you. Say goodbye to financial stress and hello to a brighter financial future. Take the first step towards financial wellness and start rebuilding your financial life today. ADHD taxes don’t have to define your financial destiny - take back control now!”

Conclusion: Breaking Free from the ADHD Tax: Summary of key takeaways and encouragement for individuals with ADHD to take control of their finances.

Breaking Free from the ADHD Tax: Empowering Individuals with ADHD to Master Their Finances

In conclusion, managing finances can be a daunting task, especially for individuals with ADHD. The “ADHD tax” refers to the extra fees, penalties, and lost opportunities that result from impulsive spending, missed payments, and poor financial planning. However, by understanding the unique challenges of ADHD and implementing strategies to overcome them, individuals can break free from the ADHD tax and take control of their financial lives. Key takeaways include:

- Recognizing the impact of ADHD on financial decision-making and planning

- Implementing systems to stay organized and on top of financial tasks

- Avoiding impulsive spending through delayed gratification and mindful consumption

- Building an emergency fund to cover unexpected expenses

- Seeking support from professionals, peers, and technology

By acknowledging the complexities of ADHD and adapting financial strategies to meet their unique needs, individuals can overcome the ADHD tax and achieve long-term financial stability and success.

Important Sources

| Filing Taxes: An ADHD-Friendly Guide - ADDitude | The ADHD-Friendly Guide to Filing Taxes . Why do so many of us put off doing taxes until April? Because it’s all so overwhelming! Use these tips to overcome common hurdles, find the right paperwork, and simplify the process so you’re done before April 15. By Harriet Steinberg Verified Updated on February 27, 2024 . |

| ADHD Tax: What It Is and How to Avoid It - U.S. News | The ADHD tax can upend an entire household’s stability. “Work can be a huge issue,” Anderson says. "People with ADHD can go from zero to 100 in a second, getting really excited or really upset. |

| What is the ADHD tax? - Understood | The ADHD tax refers to the extra effort, resources, and time people with ADHD put into tasks that may be easier for others. It’s not an actual tax people have to pay, but it can still cost money. The ADHD tax can be a literal price people with ADHD pay as a result of the choices we make. Or it can refer to an emotional cost, like the feelings ... |

| ADHD Tax: Seeking Financial Wellness After Money Problems - ADDitude | The ADHD Tax Is Draining — Financially and Emotionally. ADHD exacts financial and emotional costs – sometimes referred to as the ADHD tax – that carry a heavy burden. Use this guide to help you understand the dreaded ADHD tax and learn how to achieve financial wellness after money problems. By Rick Webster Verified Updated on April 18, 2023. |

| The ADHD Tax Includes Impulse Spending, Late Fees, Lost Jobs - ADDitude | “Literally, the ADHD tax is a big problem for me. I haven’t done a tax return for four years now. It is a combination of time blindness — four years have slipped by in the blink of an eye — and the frustration caused by having to use a non-user-friendly digital process.” — Robyn, Australia. The ADHD Tax: Next Steps |

| The Financial Toll of Living with ADHD - Verywell Mind | While many people think of ADHD as just struggling to focus or being easily distracted, the condition actually impacts most executive functions, including the ones needed for managing money. For example, poor working memory can cause you to forget dinner is in the oven, forget a bill is due, miss a doctor’s appointment (and get stuck paying a ... |

| Understanding the ADHD Tax: How ADHD Impacts Financial Wellness ... | The ADHD tax is a compound term that refers to the supplementary costs and challenges that come with the distinctive features of Attention Deficit Hyperactivity Disorder (ADHD). It could be money, emotional stress or the extra time and energy needed to carry out these tasks. These additional costs and challenges happen because people living ... |

| What “ADHD Tax” Means – And How to Avoid Paying It – Frida | “ADHD tax” is a term that refers to costs incurred due to symptoms of ADHD. That tax can cost people with ADHD to spend more money, resources, and mental effort on life than people without ADHD. And the more ADHD tax you have to pay, the more challenges can compound, increasing those costs further. In this article, we cover some of the most ... |

| The ADHD Tax Is Draining — Financially and Emotionally | Hence the “ ADHD tax ” – a term that refers to the obvious and hidden costs of living with the condition. But the ADHD tax isn’t collected in money alone. Other costs associated with ADHD – like constant guilt and shame, compromised relationships, and poor self-esteem – often weigh more and do more damage than any monetary penalty ... |

| How Much Tax Have You Paid Because of Your ADHD Symptoms? | The 'ADHD Tax' refers to the financial burden often incurred due to unmanaged ADHD symptoms. This can manifest in various ways, such as late fees due to forgetfulness, impulsive spending, or costs from disorganization and lost items. While not a literal tax, these expenses can significantly impact one's finances. |